A down payment, typically 5-20% of a property's value, is a critical aspect of real estate transactions. It influences negotiation power, loan terms, and financial security for both buyers and sellers. Market conditions, loan-to-value ratios, and individual financial goals determine the optimal down payment size. Strategically planning and understanding these factors ensures a successful transition to homeownership in today's competitive market.

In the competitive real estate market, understanding down payment requirements is paramount for both buyers and sellers. This crucial aspect significantly influences the financial journey of every transaction. However, navigating the intricacies of down payments can pose a challenge, often leaving room for confusion and misinformed decisions. This article aims to demystify this process by providing a comprehensive breakdown. We will analyze various factors that constitute a seller’s down payment, offering insights tailored to enhance informed decision-making. By the end, readers will be equipped with the knowledge necessary to navigate this essential step with confidence.

Understanding Down Payment Requirements for Sellers

For sellers navigating the real estate market, understanding down payment requirements is a crucial step in the process. A down payment, typically a significant percentage of the property’s purchase price, serves as a commitment from the buyer and a financial security measure for the seller. This initial outlay not only demonstrates the buyer’s ability to finance the transaction but also plays a pivotal role in securing the loan and establishing the terms of the sale.

When considering the down payment, it’s essential to differentiate between principal and interest. The principal is the original amount borrowed, while interest represents the cost of borrowing money over time. In many cases, lenders require a down payment equivalent to 20% of the property’s value, covering both the principal and a portion of the estimated interest. For instance, on a $500,000 home, this could translate to a $100,000 down payment—a substantial sum that significantly impacts a seller’s financial strategy. However, market conditions and loan programs can offer flexibility; some lenders may approve lower down payments, as low as 5%, though this might result in higher interest rates or additional fees.

Sellers should approach the down payment with strategic thinking. Saving for a larger down payment can reduce the buyer’s outlay at closing and potentially increase negotiation power. Conversely, utilizing assistance programs designed to support first-time homebuyers or considering alternative financing options can make homeownership more accessible. For example, some government initiatives offer grants or low-interest loans to qualifying buyers, easing the financial burden of the initial down payment. Ultimately, a comprehensive understanding of local real estate trends, loan products, and personal financial capabilities is key to making informed decisions regarding down payment requirements, ensuring a smooth transition into homeownership for both buyer and seller.

Factors Influencing the Down Payment Amount

The down payment, a crucial component of any real estate transaction, is often a point of contention for both sellers and buyers. For sellers, understanding the factors influencing this amount can significantly impact their financial strategy and negotiating power. Several key elements determine the size of a down payment, each with its own implications.

One primary factor is the loan-to-value ratio, which directly affects the financing options available to the seller. In general, lenders prefer a larger down payment as it reduces the risk associated with providing a mortgage. For instance, a seller putting down 20% may have more negotiating power compared to one offering only 5%. This is because the higher the down payment principal and interest (1-3 times the initial investment), the less exposure the lender has in case of default, allowing for potentially better terms on the loan.

Market conditions also play a pivotal role. In competitive real estate markets, sellers might need to offer more substantial down payments to attract buyers. Conversely, during slower periods, there could be opportunities for lower down payments due to increased buyer interest and willingness to negotiate. For example, a study by the National Association of Realtors (NAR) revealed that in 2022, the median down payment for sellers was 10%, reflecting the dynamic nature of this aspect.

Additionally, the seller’s financial situation and goals should guide their decision. Those planning to remain in the property for an extended period may opt for a smaller initial investment, as they’ll have more time to build equity. In contrast, sellers looking to quickly move on could choose a larger down payment to reduce holding costs or secure more favorable financing terms in the short term.

The Role of Down Payments in Real Estate Transactions

In real estate transactions, the role of a down payment cannot be overstated. It serves as a crucial financial pillar, safeguarding both the buyer and seller in a deal. Traditionally, a down payment is a percentage of the purchase price paid by the buyer upfront, demonstrating their commitment to the transaction. This gesture signifies not just financial readiness but also a genuine interest in securing the property. For sellers, understanding the mechanics of this initial payment offers valuable insights into potential buyers’ serious intentions and financial capabilities.

A down payment typically covers anywhere from 5% to 20% of the home’s price, with averages varying by market conditions and loan type. When a buyer makes a substantial down payment—say, 10-20% of the principal amount—it reduces the overall risk for the seller. This is because a larger down payment often translates to a smaller remaining balance on the loan, which in turn lowers the seller’s exposure to interest payments over time. For instance, a $200,000 home with an 8% interest rate and a 15% down payment would result in lower monthly payments and less total interest paid compared to a smaller down payment. This dynamic highlights the strategic advantage of encouraging—and accepting—adequate down payments from prospective buyers.

Furthermore, the down payment principal and interest are key considerations for both parties. A buyer who puts down a larger amount not only reduces their financial burden but also establishes a stronger equity position from the outset. Sellers, on the other hand, benefit from reduced risk and potential savings in interest costs. In today’s market, where homes appreciate at varying rates, having a solid down payment can provide buyers with more negotiating power while offering sellers peace of mind. Ultimately, an informed understanding of down payments empowers both buyers and sellers to navigate real estate transactions with confidence and strategic foresight.

Strategies to Secure a Competitive Down Payment

Securing a competitive down payment is a strategic move for sellers looking to gain an edge in today’s competitive real estate market. A well-planned approach can significantly impact the negotiation process and the overall sale price. Sellers must understand that the down payment, encompassing both principal and interest, serves as a powerful tool to attract buyers and demonstrate financial strength.

One effective strategy is to offer a down payment that accounts for 20% of the property’s purchase price. This percentage has long been considered a benchmark, indicating to potential buyers that the seller is well-financed and serious about purchasing the property. For instance, if a home is listed at $500,000, a down payment of $100,000 would be substantial. Such a gesture can create a positive first impression and encourage buyers to consider the seller’s offer seriously. Furthermore, sellers can differentiate themselves by structuring their down payment to cover 1-3 times the annual interest on the loan, demonstrating not only financial capability but also a deep understanding of the market dynamics.

Another strategic approach involves considering the current interest rates in the market. If rates are relatively low, sellers might opt for a larger down payment principal, utilizing the savings from lower interest payments over time. This strategy can make their offer more compelling and potentially fast-track the sale process. For example, paying off an additional 10% of the principal upfront can significantly reduce the overall interest burden on the buyer, making it an attractive proposition. Ultimately, by employing these tactics, sellers can position themselves as responsible and financially astute individuals, which may be the deciding factor in a competitive market.

Legal Considerations and Down Payment Agreements

When it comes to real estate transactions, the down payment is a crucial aspect that both buyers and sellers must carefully navigate. For sellers, understanding legal considerations and down payment agreements is essential for making informed decisions and ensuring a smooth selling process. This involves delving into the intricacies of contracts, financial structures, and the role of the down payment in securing the deal.

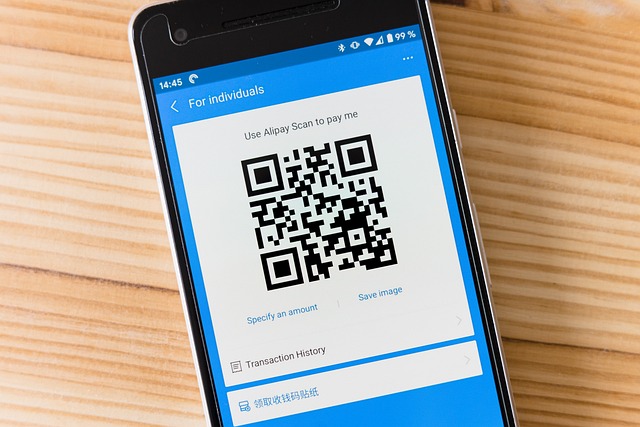

One of the primary legal aspects to consider is the agreement between the buyer and seller regarding the down payment. This document should clearly outline the amount, terms, and conditions associated with the down payment. For instance, a common practice is to have the buyer pay a certain percentage (e.g., 2-5%) of the property’s sale price upfront as a down payment. This serves as a good faith gesture and demonstrates the buyer’s commitment to the transaction. The agreement should also specify whether the down payment includes principal and interest, which can be particularly relevant when dealing with financing options. Down payment principal represents the actual contribution towards the purchase price, while interest adds an additional financial burden, typically calculated based on market rates and the loan term.

Moreover, sellers must be aware of their rights and obligations in relation to the down payment. In the event that a buyer defaults on the agreement, the seller can legally retain the down payment as compensation for any losses incurred. However, it is imperative to ensure that all terms are fair and compliant with local laws to avoid potential disputes or legal complications. Sellers should also consider offering incentives or concessions to buyers who make larger down payments, such as waiving certain fees or providing a more competitive closing date. By carefully managing these aspects, sellers can maximize their negotiating power while maintaining a transparent and legally sound process.

Maximizing Your Offer: Tips for Effective Down Payment

Down payment is a critical aspect of purchasing a home, significantly impacting your financial journey as a seller. This strategic move can maximize your offer’s competitiveness in today’s vibrant real estate market. Understanding down payment dynamics allows you to navigate the process effectively, potentially securing favorable terms and an efficient closing.

Maximizing your down payment involves balancing the principal and interest components. Traditionally, lenders recommend a down payment equivalent to at least 20% of the property’s purchase price. This substantial investment reduces the loan amount, thereby lowering both the principal and interest you’ll pay over time. For instance, consider a $300,000 home; a 20% down payment equates to $60,000, which can result in significantly lower monthly mortgage payments compared to a smaller down payment. A higher down payment not only reduces your debt burden but also showcases your financial commitment to the seller, enhancing the credibility of your offer.

Furthermore, strategic planning can help you build a substantial down payment. This might involve budgeting effectively, prioritizing savings, and exploring options like gifted funds or grants available through specific programs. It’s essential to research and consult with mortgage professionals who can provide insights tailored to your financial situation. By combining responsible saving habits with expert guidance on down payment strategies, sellers can position themselves for success in the competitive home-buying market.